The password must have between 8 and 15 characters with the following requirements

- Minimum one number (0-9)

- Minimum lowercase letter (a-z)

- Minimum one uppercase letter (A-Z)

- Minimum one special character "#?!@$%^&*-+<=>"

- Example password 99azTR?!@

Virtual terminal for MOTO payments

Virtual POS terminal for MOTO payments (Mail order/Telephone order) is one of the most requested payment methods in e-commerce sector but at the same time the hardest to contract. Only few financial entities grant to newly created and some already existing businesses a possibility to charge their clients via phone or e-mail. What are the reasons behind that?

Virtual terminals for MOTO payments involve high risk of chargebacks and fraud and this is the main reason why a lot of banks don’t authorize this payment method to newly registered companies. The main characteristic of this POS terminal is its ability to charge any credit card, whether or not it has 3D security protocol activated, without the presence or authorization of the cardholder.

In order to understand better the operation process of MOTO payment method, we have to know what MOTO payment is.

What is a Virtual POS terminal for MOTO payments?

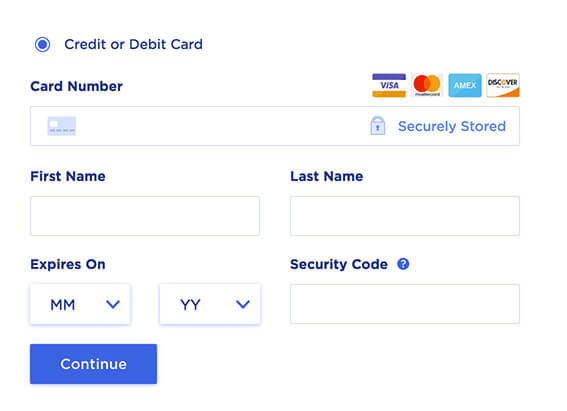

A use of MOTO to charge your clients' credit cards does not mean exactly that the payment process is made via phone or e-mail. It is a manual or automatic process where a business accepts a non-present card payment through a form in a payment gateway. That is, once the merchant has all the card information (type of card (Visa, MC, Amex), credit card number, expiration date and CVC number) and the terminal activated in MOTO mode, he can charge the customer any amount without his presence. In case of using this system fraudulently, the terminal could make successive charges from the same IP or different countries causing serious damage to the financial institution and cardholder.

Regarding its functioning, the MOTO payment system can be classified into 2 types:

- Manual MOTO payment processing: the merchant can enter the data of the card manually and charge the credit card with or without the authorization of the cardholder.

- Automatic MOTO payment processing: this process of accepting payments works through voice recording and data collection software that makes automatic calls to clients’ phone numbers and asks them for their credit card information. The advantage of this system is that there is no intervention of any physical person that involves human factor, but the most significant disadvantage is high cost of national and international calls to landlines or mobile phones.

MOTO payment processing work without 3D Secure protocol and is mostly used by high-risk businesses although sometimes low-risk merchants get to use it due to the nature of their commercial activities. The types of terminals for MOTO payments and the businesses these are intended for are the following:

High risk virtual terminal for MOTO payments

The high-risk terminal for MOTO is a terminal that doesn’t not require the physical presence of the cardholder and therefore implies a very high risk of chargebacks and fraudulent activities. The types of businesses that require high risk MOTO payment processing are the following:

Call centers with high turnover, tarot, software support, insurance contracting, tax and legal advice, multi-level marketing, dating websites and scholarship applications.

Low risk virtual terminal for MOTO payments

Low risk terminals for MOTO do not require the physical presence of the cardholder but the risk of chargebacks involved is quite lower due to the lower risk of commercial activities of the merchant. The types businesses that require low risk MOTO payment processing are the following:

Call centers with low turnovers, request and cancellation of credits, collection agencies for defaulters, collection of commissions for loans between individuals, payment protection insurance and flight contracting.

As you were able to see the usage of MOTO payment processing method is the best option as long as the operation of your online business allows it. You have to be very careful when charging cards of your clients since the risk of chargebacks is high and generally the claims placed against the business get resolved in favor of the cardholder.

Make a question or comment

Recent posts

What is a payment portal?

What types of online payment platforms exist?

The best online payment methods

What is Pin Pad and why you need it for your business?

PSD2 regulation: How will it affect E-Commerce?

What international payment methods are the most used on the Internet?

What is a payment gateway? How does it work?

What is a traditional virtual POS for Web sites?

PAYMENT METHODS

Payment gateway website

MOTO payment

Recurring payment

Bank accounts

Pre-Approval Form MID

Fill out the Pre-Apprival form as accurate as possible to help our IPSP understand your business and open your payment terminal as soon as possible. If you have doubts about the terminal to choose you can clarify your doubts in the following links:

- Online virtual POS for websites

- MOTO terminal or charge by phone

- Recurring payments

- Offline POS

Dear Nenad,

Unfortunately right now we can not offer you MOTO payments service. However, we are constantly working on establishing new relationships with our providers and once we can provide you with this service, one of our agents will contact you.

Regards

I already completed Pre - approval form waiting for response Please to update me about my query Thanks & Regards Anup Singh APP TRADING LIMITED